Adp withholding calculator

For example if an employee makes 25 per hour and. Get Started With ADP Payroll.

Adp Integration With Prebuilt Connectors From Modulus Data

To help you get the most accurate.

. Below is an example of a pay stub from ADP your employers payroll processor. All Services Backed by Tax Guarantee. For employees withholding is the amount of federal income tax withheld from your paycheck.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Just enter the wages tax withholdings and. IRS tax forms.

Plug in the amount of money youd like to take home. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Virginia Paycheck Calculator Use ADPs Virginia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Adp withholding calculator Selasa 13 September 2022 Chinook Building 401 Fifth Ave. The calculator on this page uses the percentage method which calculates tax withholding. Ad Calculate Your Payroll With ADP Payroll.

Process Payroll Faster Easier With ADP Payroll. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Process Payroll Faster Easier With ADP Payroll.

Ask your employer if they use an automated. Important Note on Calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The calculator on this page uses the percentage method which calculates tax withholding. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Important Note on Calculator.

Process Payroll Faster Easier With ADP Payroll. Just enter the wages tax withholdings and. This tax calculator helps you determine just how much withholding allowance or added.

Multiply the hourly wage by the number of hours worked per week. Important Note on Calculator. Then multiply that number by the total number of weeks in a year 52.

Get 3 Months Free Payroll. Next divide this number from the. Get Your Quote Today with SurePayroll.

For instance a paycheck calculator can calculate your. Get Started Today with 2 Months Free. Our free paycheck calculator makes it easy for you to calculate pay and withholdings.

Withholding info click Federal. 3 Review the intro page. Our free salary paycheck calculator below can help you and your employees estimate their paycheck ahead of time.

2 Click Edit Withholding. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Our free paycheck calculator makes it easy for you to calculate pay and withholdings.

Youre almost done be sure to include federal filing details and extra tax. The IRS recommends that taxpayers access the online W-4 Calculator to check their payroll withholding and adjust withholding allowances if needed as early as possible. The withholding calculator can help you figure the right amount of withholdings.

Ad Calculate Your Payroll With ADP Payroll. If you dont see the Edit Withholding button speak with your employer. The amount of income tax your employer withholds from your regular pay.

New York Paycheck Calculator Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. To change your tax withholding amount. Get Started With ADP Payroll.

Get 3 Months Free Payroll.

2

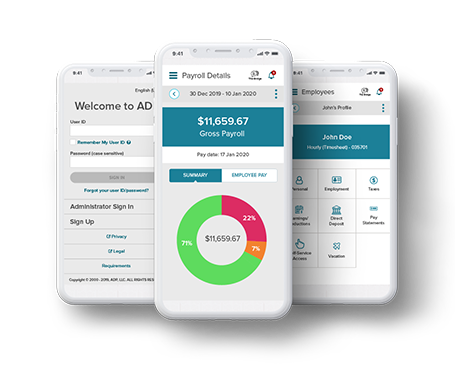

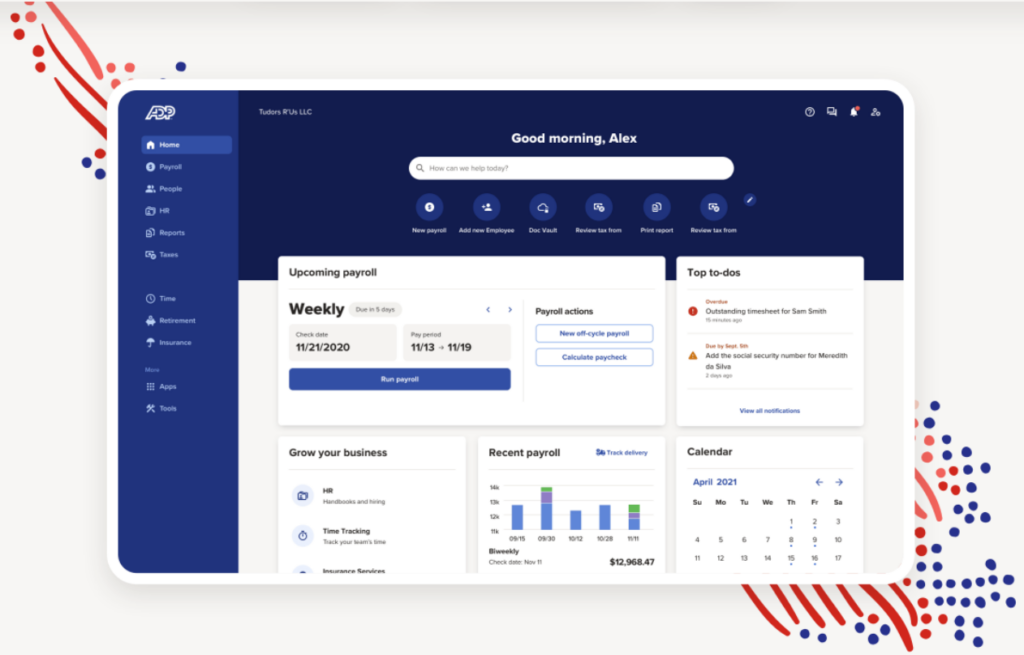

Payroll For Medium Sized Businesses Adp

2

2

Pclaw And Adp Payroll

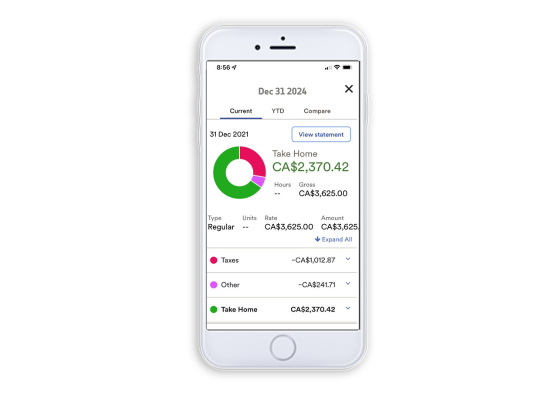

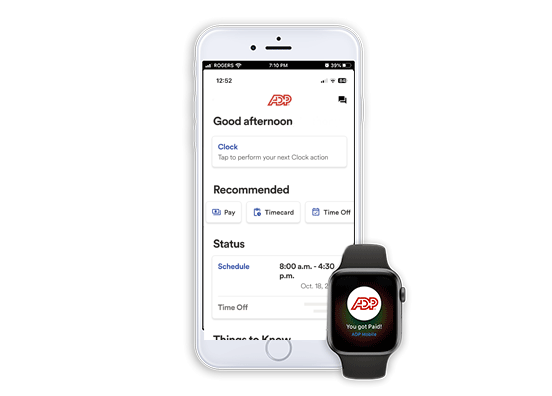

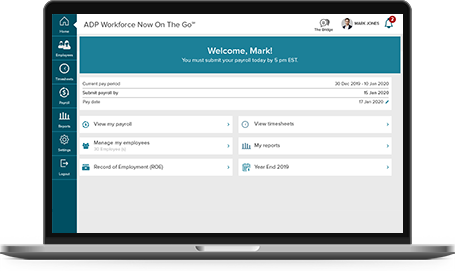

Adp Workforce Now On The Go Payroll Time Tracking Software Adp Canada

Adp S Ezlabormanager And Run Processing Payroll Youtube

Adp Mobile Solutions Free Mobile App Adp Canada

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Adp Payroll Review Should You Use It

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

Adp Workforce Now Demo Youtube

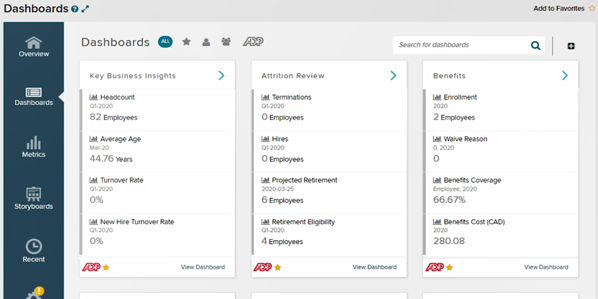

Adp Workforce Now Data Insights Reporting Adp Canada

Pin On Payroll Checks

Adp Mobile Solutions Free Mobile App Adp Canada

Adp Workforce Now On The Go Payroll Time Tracking Software Adp Canada

Seo Title Adp Payroll Review The Pros And Cons